Thanks to Explosive Growth, the Bay State is Quickly Nearing 200 Breweries. But How Many Is Too Many?

Despite an unusually high number of brewery closures in Massachusetts this year (at last count 9, with several more likely), including some well known and respected brands, the fast pace of brewery openings shows no signs of slowing down. In addition to the 19 new breweries that have already opened, we’re aware of another 20 (including some existing brands opening second locations) that intend to launch between now and the end of the year, or at latest early 2020.

The Alcohol and Tobacco Tax and Trade Bureau (TTB) currently lists 247 federal licenses for Massachusetts, meaning the number of planned new breweries could be even higher than our estimate. As the Brewers Association (BA) recently reported, one of the hardest things to track in the industry is the number of breweries in planning. That said, it’s safe to assume that 2020 will be another year of double digit growth. So have we reached saturation, or as some put it, peak beer? Is there a looming beer bubble that’s about to burst? The short answer is probably not, but it’s complicated.

“Having so many players has created a hyper-competitive marketplace where new and small have a chance, and everyone else is struggling to tread water.”

The recent announcement from revered Mystic Brewery that it plans to close, followed by news that Somerville Brewing, aka Slumbrew, is facing financial difficulty at its Assembly Row gastro pub (both locations remain open) sent shockwaves through the local beer scene. And we’d be lying if we said we haven’t heard our share of rumors lately about other established breweries struggling to make ends meet. Several of them are whispered to be going up for sale or out of business. One of them, Down the Road Brewery, which closed suddenly in early August when its founder unexpectedly passed away, is unlikely to re-open due to substantial debt, in part due to its latest expansion, according to a story in the Everett Independent.

Considering that national growth for craft beer sales topped out at around 4% both last year and this (partly due to to the rising popularity of spirits, hard seltzer, and even non-alcoholic beverages), competition is only likely to get stiffer. In a blog we posted more than two years ago, Night Shift’s Rob Burns, president of the MBG, warned that not everybody is likely to make it in an ultra-competitive environment.

According to Bart Watson, chief economist for the BA, “overall demand for beers from small and independent brewers continues to increase, but at levels that make it difficult for all breweries to grow simultaneously.” Translation: as the craft beer landscape gets more competitive it will result in a more fragmented market with a lot more haves and have-nots than was previously the case.

Some of the haves gobbling up market share from legacy brands and others include growing regionals such as Wachusett, Night Shift, Jack’s Abby, and Tree House, as well as newish breweries like Greater Good or Lamplighter who are on similar trajectories to their predecessors. The have-nots are likely to be those with challenging locations, mediocre beer quality, or less than prudent business plans. David Fields, managing partner of another rapidly expanding brewery, Wormtown, says the current environment reminds him of the shakeout that happened a couple of decades ago. “It’s starting to look a little like the late 1990’s, with people taking on too much debt or accepting outside money to make a quick buck. Just like then, it’s likely to result in some mistakes, and some bad beer making it to market.”

One of the problems for new breweries, says Fields, is that finding quality people is getting harder. With such rapid growth in recent years there are fewer seasoned brewers available. A number of industry veterans we’ve spoken to question whether all the home brewers starting breweries without any commercial experience is good for the industry. In his most recent Hoppy Boston post local blogger Ryan Brawn thinks the recent rate of growth is unsustainable. He thinks we’ll see a slowdown soon where the number of brewery openings are somewhat balanced by closings.

Even so, it’s probably not going to result in a wave of closings, or even a slow down of new openings. “Most breweries that have opened in the last few years have had the bubble in the back of their mind,” says Mike Patterson, cofounder of Small Change Brewing, a Somerville-based contract brand transitioning to the taproom model. “I don’t think it’s reached saturation though, at least not for a small brewery with a taproom. Nobody complains about being able to walk to a local brewery in their neighborhood.”

Suzanne Schalow, co-founder of Craft Beer Cellar, a retail chain of specialty beer stores, agrees. Though she reminds consumers of the realities that come with running a business. “The industry looks so fun and vibrant, yet at the end of the day it’s a business. Owners must decide what works best for them and their financial expectations. It’s very hard work, especially in the early years. But the industry will continue to grow, for certain!”

As the BA highlighted in its midyear report, however, more brands are shrinking than are growing, and it’s getting really hard in distribution right now. Which might explain why Patterson and a number of other production or contract brands are pursuing neighborhood taprooms, which will allow them to more easily keep up with the trends of new (constant variety) and more (higher ABV) that continue to dominate sales. And as the BA’s Watson points out, “the fracturing of the marketplace with so many players has created a hyper-competitive environment, where new and small have a chance, and almost everyone else is struggling just to tread water.”

“The closure rate is certainly ticking up, but the number of new breweries continues to grow.”

Not coincidentally, it’s been a while since we’ve heard many established brewery owners touting the often used a rising tide floats all boats line in response to news of a new brewery opening in their area. Market share is getting tight, and when some of the flourishing breweries grow to the size of cruise liners, the marina can suddenly seem a lot more crowded for smaller vessels. According to state alcohol tax records, just a dozen or so of the state’s breweries accounted for the vast majority of growth in 2018, and many of them are in the process of opening additional locations,

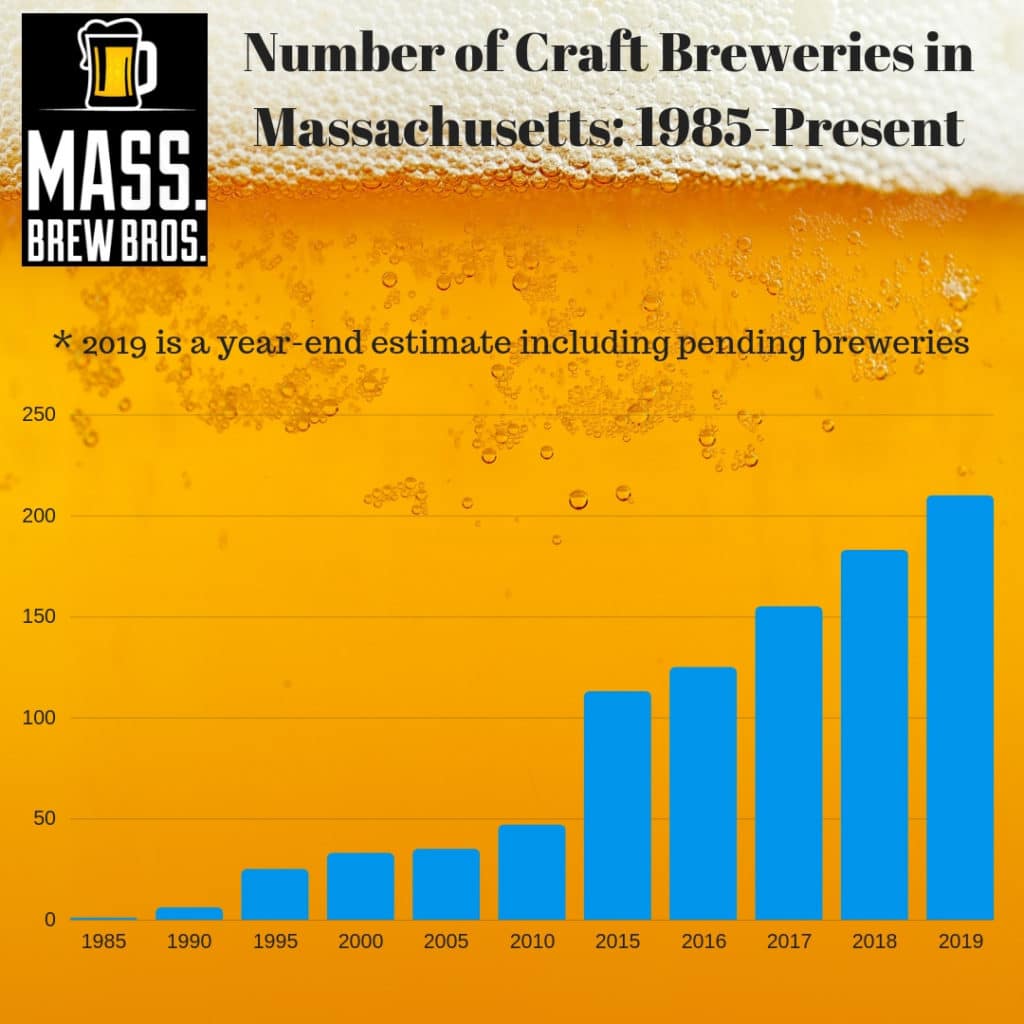

The number of breweries in Massachusetts has twice doubled in the last decade, growing from less than 50 to more than 200 (our projection) by year’s end.

“It’s pretty clear the last 15 years of craft brewing [expansion] have come to an end, where [everyone] was growing double digits every year,” says Boston Beer founder Jim Koch, whose Sam Adams brand has lost considerable market share in recent years but still sells more than 400,000 barrels of beer annually in Massachusetts. “The overall growth outside of taprooms is down to single digits, at the same time there are literally 1,000 new breweries entering every year. The market’s growing two percent, the number of breweries is growing 15 percent.”

Some surprises and disappointments may be ahead, but It’s probably not time to hit the panic button. In a blog post earlier this year, noted beer writer Jeff Alworth likened the current situation to an industry stress test, saying that it’s not catastrophic, but it’s a flat market in which growth of some breweries comes at the expense of others. Some will fail the test, he predicts, but the ones that survive will be stronger and more stable when the next growth cycle arrives. “The closure rate is certainly ticking up,” says Bob Pease, President of the BA, “but the number of new breweries continues to grow.” And, he notes, “small and independent breweries only have 13.2% of the beer market by volume, I don’t think there’s any reason they can’t get to 20%.”

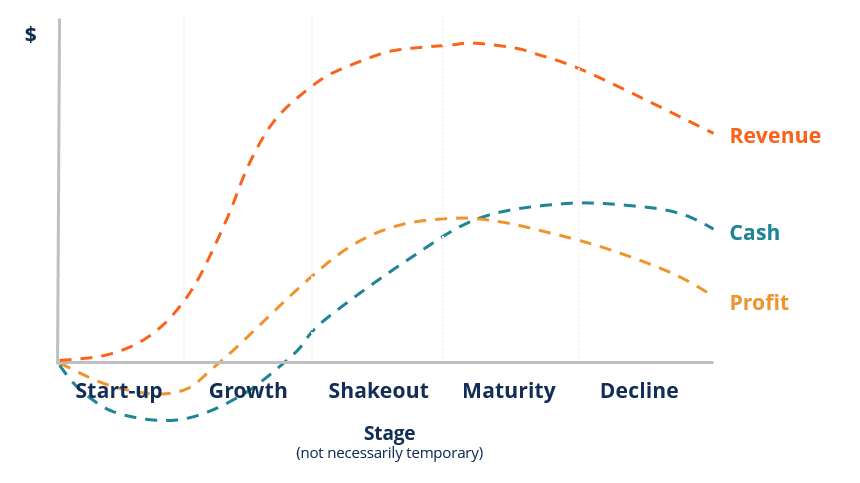

Industry Life Cycle

The above chart depicts the stages of an industry and typically consists of 5 stages – startup, growth, shakeout, maturity, decline.

According to the above chart from the Corporate Financial Institute, most industries will progress through a life cycle that consists of five stages, each lasting for varying lengths of time (months, years, even decades). According to the CFI website, “at the shakeout stage revenue growth, cash flows and profits start slowing down as an industry approaches maturity. At the maturity stage, the majority of the companies in the industry are well-established and the industry reaches it saturation point.”

So which stage is the craft beer industry in? According to who you ask, somewhere in the neighborhood of shakeout, perhaps moving quickly toward maturity, at least here in Massachusetts. Results from a recent Twitter poll we posted indicate that more than a third of consumers believe we’ve reached saturation or peak beer. That’s in stark contrast to a 2017 poll we conducted, when just 5 percent of respondents believed there was a bubble. The truth is, none of us really knows just yet. As Beer Advocate columnist Andy Crouch has observed, “no one knows where things are going, whether up, down, or sideways. And there’s something amazing about that unpredictability – a future fresh with possibility but laced with hints of uncertainty.”

Admittedly there’s more at stake here than pundits and consumers speculating about the future of the industry, especially when it doesn’t directly effect them. The dreams and even livelihoods of brewery owners and their employees are at stake. Not to mention the industry’s significance on the Massachusetts economy. In its most recent economic impact report, the BA estimated that the craft brewing industry contributed more than 2 billion dollars to the Commonwealth’s economy in 2018.

Despite what may be tougher, or at least more competitive, times ahead for the local craft beer scene, most consumers seem intent on keeping calm and carrying, or in this context, drinking on. “I don’t think it’s a bubble,” says craft connoisseur and Boston native Jocelyn Bartlett. “But it does remind me to visit the places I love as much as possible.” ![]()

For new breweries, it is all about the taproom. You will lose money for a very long time brewing beer, your hope will be that pouring it will make up for that. Cross your fingers that Massachusetts does not put in new restrictions on taproom sales.

I’m not in the industry, but just a consumer. I think it repeatedly comes to do a quality product. I respected Mystic for doing less trendy styles, but never found quality when they went after the IPA market. Somerville…never found excellent products. I don’t understand the appeal of Wormtown either. Conversely, I think Lamplighter and Exhibit A are consistently superb. Rapid growth always equates to consolidation in any industry. I think in two years we’ll really see the cream rise to the top.

Hey Roger: We’d have to respectfully disagree with the idea that the cream, or “quality” breweries, as you put it will rise to the top. First off, one person’s quality is not the same as the next person’s. Case in point, the vast majority of craft drinkers would completely disagree with your characterization of Mystic, Wormtown, and even Slumbrew. And our experiences with more than a dozen blind tasting panels has proven that perception is far more influential on people’s ratings than they like to think. In fact, we’d go out on a limb and say that if you blind taste tested the five breweries mentioned in your comment you would probably be at least partly surprised at the results. Let us know if you’d like to take part in our next event.

Hey Robert: We agree that the taproom model, which is far more lucrative on a per barrel sold basis, is of significant importance for many breweries, especially smaller and newer ones. That said, some relatively new breweries such as Lamplighter are also selling a fair amount through distribution. Point is, there is no one model that will work for everyone. New brewery founders should be very careful about their business plan, and be prepared to pivot on a dime in this dynamic and competitive market.

Well written and very informative. Nice work, Rob!

From someone who very nearly entered the industry as one of those home brewers starting out contract brewing, I’m so glad I didn’t. I walk into a beer store and see the shelves stuffed with different eye-catching labels and it’s so over-stimulating that I just gravitate to something I know I like. In a taproom setting I get to try different offerings and discuss them with others while unwinding from the day or week. When you crack a beer at home you want it to be great so people (at least I do this) buy what they really love the most. There are so many beers to try and I would love to give them all a shot but have been disappointed in the past when I bring the glass to my face. I guess I’m one who plays it safe at the store but is more adventurous at the taproom, and if I was one of those breweries with beer on the shelf at the store, I can’t expect other people to buy it if I’m not doing it myself.

Most craft beers also have a ton of calories, and many are watching the calorie intake these days. I, for one, don’t want to waste my calories on a crappy or even sub-par beer with so many amazing options out there.

I guess I’m saying that the local taproom is the most appealing to me, and the lesser quality beers will be weeded out eventually.