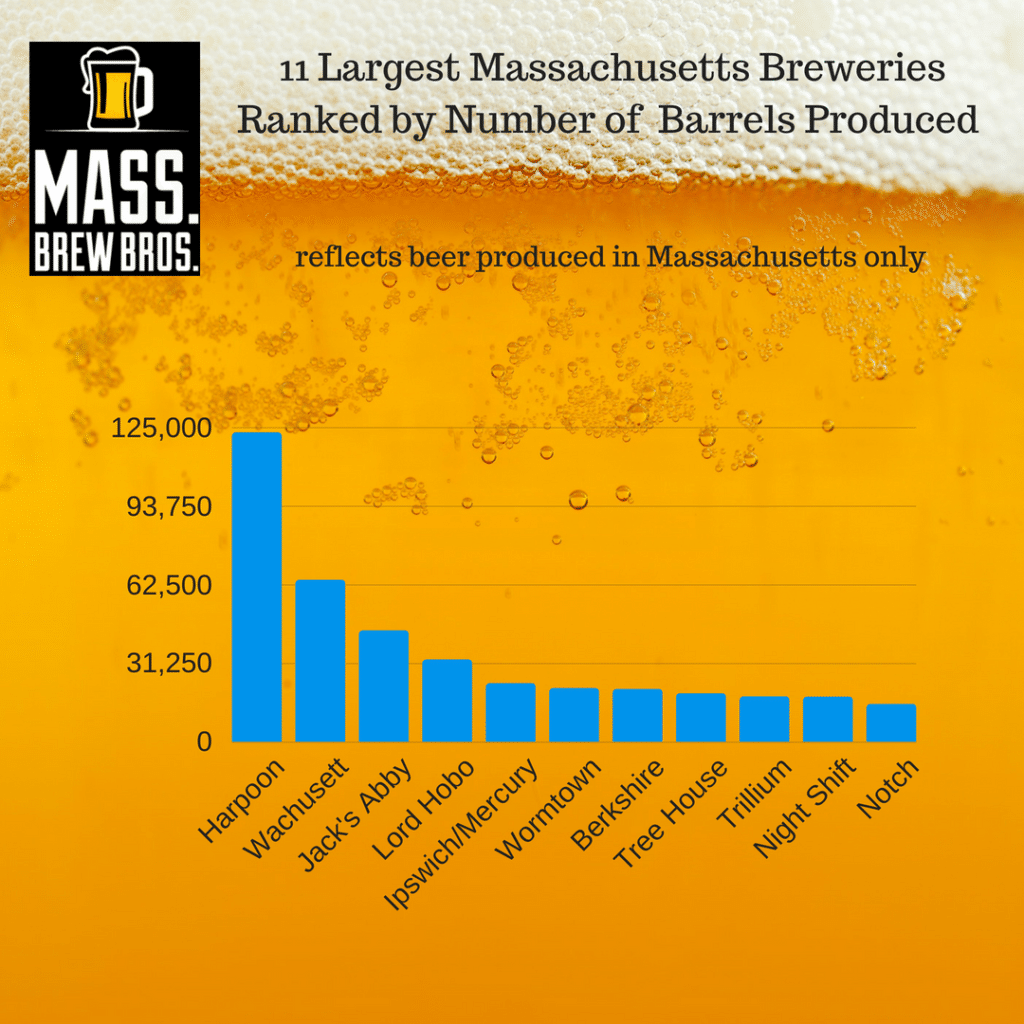

The Brewers Association (BA) recently published its annual rankings of the nation’s largest brewers, which they determine by number of barrels produced in a year. Here’s a look at how the largest Massachusetts breweries measured up to each other and to the national competition in 2017. Check out the first chart below, then scroll down for some clarification, insight, and analysis.

Numbers in the above chart represent beer produced in Massachusetts only, and have been confirmed by the brewery, or have been estimated using BA and state government data.

Of note is that Boston Beer, a publicly traded company better known by craft drinkers as Sam Adams, and the second largest craft brewer in the U.S., is not listed among the largest local breweries on our chart. Reason being, it brews less than one percent of the 2 million barrels of beer it produced in 2017 at its local R & D brewery in Jamaica Plain. Its Boston headquarters only produces beer for festivals, exclusive local draft accounts, and tour & taproom consumption according to an employee at the brewery.

Similarly, Nantucket based Cisco Brewers is not charted because it produces the bulk of its beer, estimated as 28,000 barrels in 2016 (they opted not to publish in 2017), through a partnership with Craft Brew Alliance (CBA) in Portsmouth, New Hampshire, formerly the Red Hook brewery.

Harpoon, who tops the Massachusetts list and ranks 18th nationally, produces two thirds of its 185,000 barrels at its South Boston brewery. The rest is brewed at its second facility in Vermont.

Aside from Sam Adams and Harpoon, the only other Bay State brewery to crack the top 50 nationally is Wachusett. The other eight are all ranked among the top 200, however. All of the breweries charted above are classified by the BA as Regional Breweries, which they define as craft brewers with an annual production of 15,000 barrels or more.

Of those eleven, eight saw significant growth in 2017, including Wachusett (26%), Jack’s Abby (28%), Lord Hobo (112%), Wormtown (44%), Tree House (48%), Notch (31%), Night Shift (94%), and Trillium (22%).

Two of the above breweries would have ranked higher, but a portion of their beer was produced elsewhere through contract brewing: Night Shift had just over 1,000 barrels brewed at Smuttynose in New Hampshire, and Notch likely brewed a quarter or more of its beer at Two Roads in Connecticut.

Ipswich Ale Brewery/Mercury Brewing is listed as a regional brewer, but the large majority of the beer produced there was for a variety of contract brands, including major players Clown Shoes and Notch.

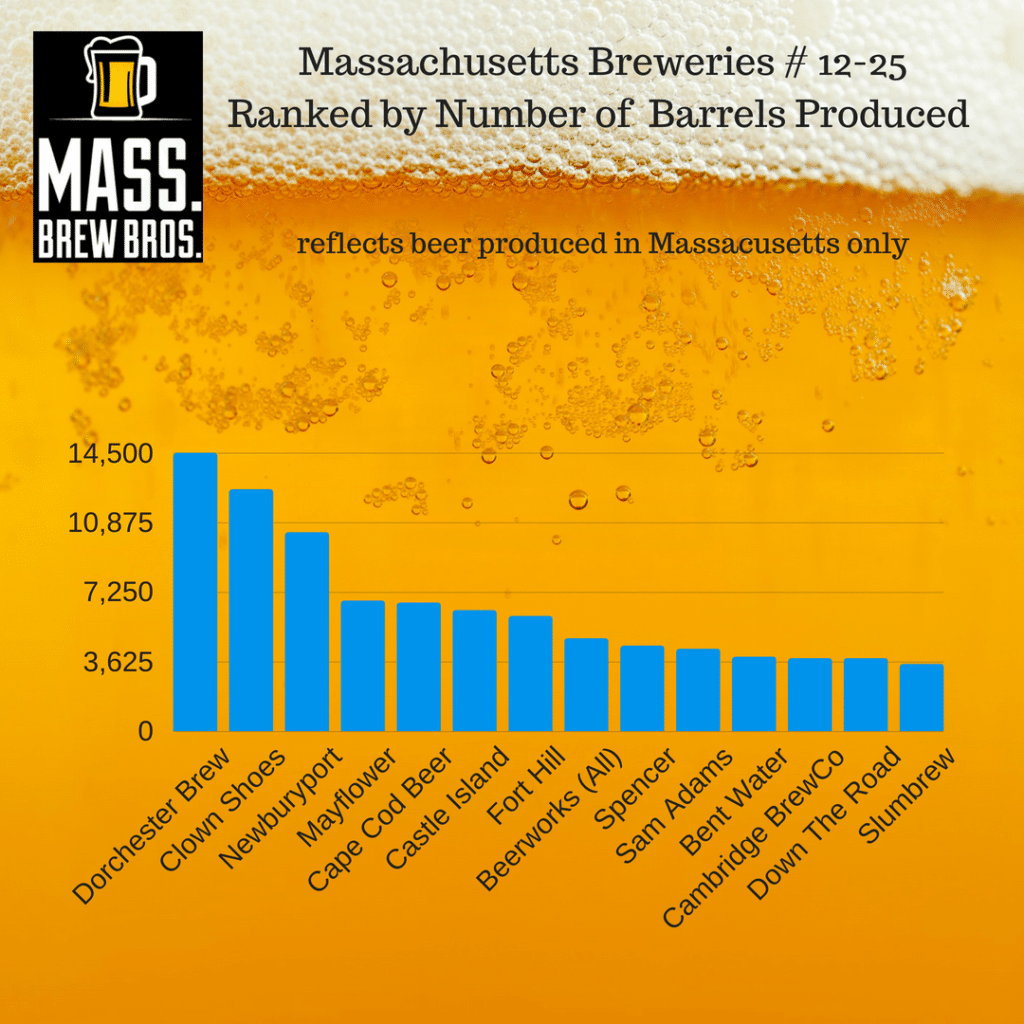

Below are the 14 largest Micro Breweries in Massachusetts (defined as an annual production of less than 15,000 barrels). Take a peek and then scroll down for more clarification, insight, and analysis.

Numbers in the above chart represent beer produced in Massachusetts only, and have been confirmed by the brewery, or have been estimated using BA and state government data.

Falling just short of regional status is Dorchester Brewing Company, who produces beer for a number of partner brewers, many of which are based outside of Massachusetts. Their local partners have included Backlash, Down the Road, Entitled, and Medford Brewing, but the roster has changed since the end of 2017. They also brew a local startup brand known as Naked Ox Beer, and more than a dozen of their own regular house beers, but those account for less than a third of their total production.

As you may know the state’s largest contract brewer, Clown Shoes, was acquired late last year by Harpoon. The founder, brewers, and sales team have taken up residence in South Boston and are all still responsible for the day-to-day operations, but Clown Shoes is now considered a brand of Harpoon and starting in 2018 its production numbers will be reflected in Harpoon’s total.

A few other changes that occurred in 2017 included Newburyport Brewing signing with Isle Brewers Guild in Rhode Island to produce some of their flagship beer there, Castle Island and Spencer Brewery taking on a limited amount of contract brewing, and Down the Road Beer Co., formerly a contract brand, moving all of its production to its new Everett brewery for 2018.

Note that the production number for Beerworks, which underwent a bit of a rebranding recently, includes all six of its locations: Framingham, Hingham, Lowell (where much of the flagship beer is produced for all locations), Salem, and two in Boston. Therefore, Cambridge Brewing Company is the state’s largest individual Brewpub.

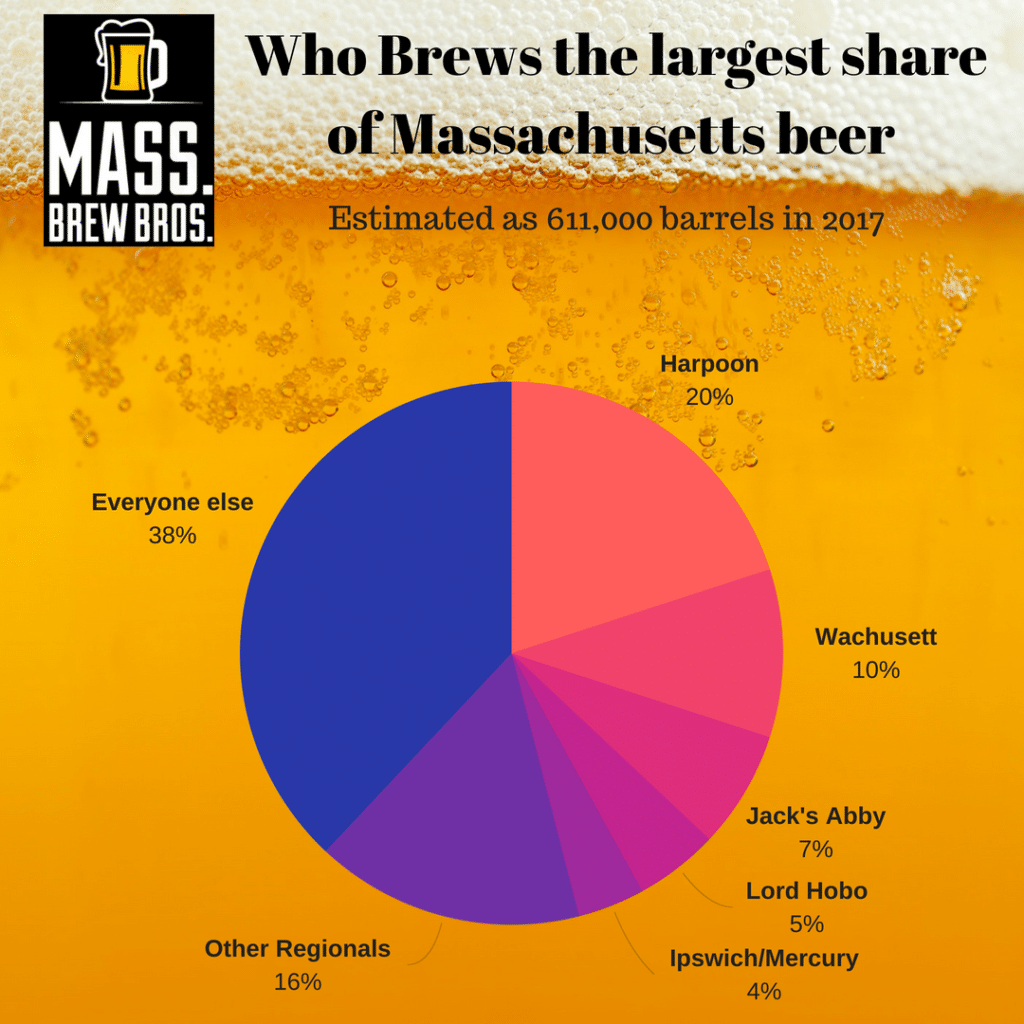

Our final chart shows how the 611,000 barrels of locally brewed beer is divided among the state’s 160 craft brewers.

The Bay State’s 11 regional brewers account for just over 60 percent of the state’s total beer production, the remaining portion comes from the other 149 micro & nano breweries.

The state’s largest players, regional brewers, account for six out of every ten locally produced craft beers in Massachusetts.

As the number of local breweries continues to grow as projected (we estimate that the state’s brewery count could reach 200 by this time next year), it will be interesting to see what the above chart looks like in a few more years.

If you have any thoughts, observations, or questions on the data presented here, hit us up in the “Submit A Comment” section below. Cheers

Related: Massachusetts Now Has 160 Craft Brewers, And Counting